Contents:

In the contemporary landscape, the Bihar Industrial Investment Promotion Policy of 2016, under the auspices of the Industry Department, classifies the tourism sector as an industry. This policy offers incentives to boost tourism, recognizing its significance in the overall sectoral growth. However, these incentives are considered insufficient for the comprehensive development of the existing tourism model. Considering these circumstances, there was a recognized need for a more effective and inclusive tourism policy in the state of Bihar.

On the 26th of December 2023, the Bihar state cabinet formally notified the Bihar Tourism Policy 2023 intending to foster increased investments in the tourism sector and augment tourist influx in the state.

©bpscexamprep.com

Vision:

Develop Bihar as centre of spiritual, cultural, and eco-tourism through sustainable and inclusive means with focus on investment and livelihood creation.

Objectives:

- Development of World-class Tourism Infrastructure with efficient participation of all stakeholders.

- Development of Tourism Products offering greatest value to the tourists.

- Developing pool of talented workforce through various skilling initiatives.

- Emphasizing highest standards of tourist safety and comfort.

- Implementing tourist centric best-in-class technology driven initiatives.

Under this tourism policy, fiscal and non-fiscal incentives will be provided to beneficiaries and investors associated with the tourism sector. These are as follows:

Fiscal Incentives:

All eligible projects shall be eligible for the following subsidy under this policy

(i) Capital Subsidy:

- Up to an investment of ₹10 crores, a subsidy of 30%, with a maximum limit of ₹3 crores.

- For investments up to ₹50 crores, a subsidy of 25%, with a maximum limit of ₹10 crores.

- For investments exceeding ₹50 crores, a subsidy of 25%, with a maximum limit of ₹25 crores.

The subsidy reimbursement will be 50% at the commencement of Commercial Operation Date (COD), 25% after two years of commercial operation, and 25% after five years of commercial operation.

or

(ii) Interest Subvention:

- Rate of interest for interest subvention will be 10% or actual rate of interest on term loan, whichever is lower to be reimbursed annually starting from COD and shall be available for a maximum period of 5 years form COD. The maximum limit for this will be the same as determined for capital subsidy.

Investors may apply for subsidy under any one of these two routes i.e., Capital Subsidy OR Interest Subvention.

Additional Subsidy:

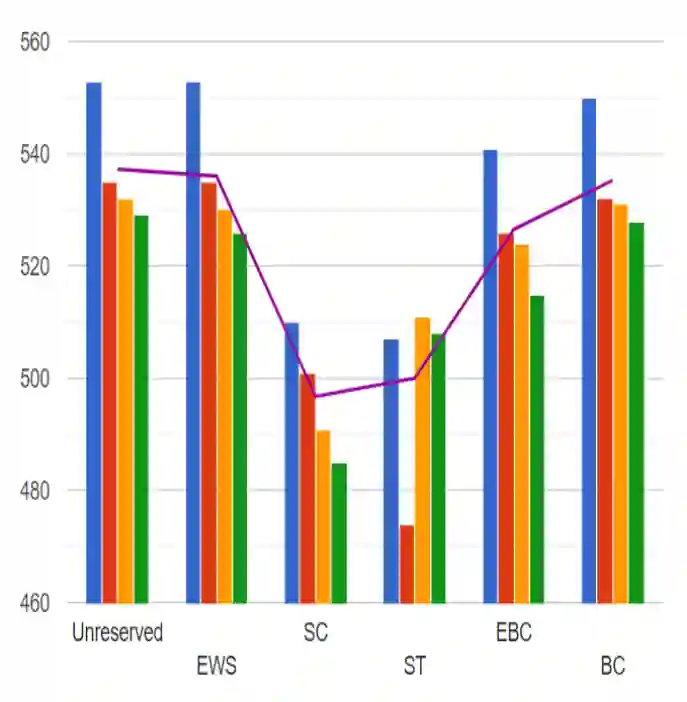

An additional subsidy of up to 5% beyond the determined maximum limit of Capital Subsidy or Interest Subvention will be provided in the following two cases:

- Projects at major international tourism destinations in the state – Gaya, Bodhgaya, Nalanda, Rajgir, Vaishali, and Valmiki Tiger Reserve.

- Special incentive for economically weaker sections / women entrepreneurs – If the new tourism project is owned by entrepreneurs from Scheduled Castes, Scheduled Tribes, Extremely Backward Classes, Backward Classes, Divyangjan (differently-abled), war widows, acid attack survivors, third gender entrepreneurs, or women entrepreneurs (with a minimum 51% ownership).

The additional 5% subsidy (Capital Subsidy or Interest subvention as the case may be) shall be allowed in only one of the above (1 or 2) categories.

Other Fiscal Incentives include:

- Full reimbursement of Land Conversion Charges.

- One-time 100% reimbursement of Stamp Duty and registration fees for land lease/sale/transfer for tourism projects.

- 80% reimbursement of SGST, capped at 100% of the approved project cost, for up to 5 years from the COD.

- 100% reimbursement of electricity duty for new tourism units for the first 5 years from the COD.

- 5% reimbursement of monthly remuneration paid to tourist guides for hotels/resorts/tour operators, up to ₹5,000 per guide per month, applicable for guides trained in certified government centres or Department of Tourism-approved programs for a period of two years from sanction date.

- 50% reimbursement of certification fees, up to ₹10 lakh, for tourism units obtaining Green Building Certificates from accredited agencies.

- MICE (Meetings, Incentives, Conferences, and Exhibitions) incentives include up to 50% GST reimbursement for organizing events in Bihar.

Incentives for empanelled Tour Operators:

Interest Subsidy on Office Establishment in Bihar – Subsidy on interest will be provided on loans obtained from any approved Scheduled Commercial Bank. The maximum amount of this subsidy will be 50% of the total interest paid in the first year of the loan tenure (maximum limit of ₹10.00 lakhs), etc.

Non-fiscal incentives:

Non-fiscal incentives refer to measures that do not involve direct financial benefits. Following are the non-fiscal incentives that shall be taken by the Department of Tourism:

- Investor Facilitation: Establishing a Single Window Clearance facility with a dedicated Project Management Unit for the Department of Tourism to aid investors.

- Standardization, Ratings, and Certification: Developing guidelines for service standardization, rating mechanisms, and certifications for service providers.

- Annual Excellence Awards: Organizing annual awards to recognize industry partners’ contributions in different categories.

- Marketing and Promotion Support: Identifying and promoting tourism projects and service providers through participation in national and international events, featuring them in promotional materials across various platforms.

Operative period of the policy:

This policy comes into effect from 26.12.2023 and shall remain in force for an initial period of five years until replaced though Government notification.

Implementation Process:

The proposals submitted under this policy shall be processed as per Bihar Industrial Promotion Act, 2016 and any amendments thereof. As per the Act, the proposal shall be subject to clearance from State Investments Promotion Board (SIPB), and based on approved project cost, shall be placed before competent authority for final approval on disbursement.

Approval authority:

- Up to ₹5 crores: Additional Chief Secretary/Principal Secretary/Secretary, Dept. of Tourism.

- Above ₹5 crores and up to ₹15 crores: Minister, Dept. of Tourism.

- Above ₹15 crores and up to ₹30 crores: Jointly by the Minister, Dept. of Tourism, and Minister, Dept. of Finance.

- Above ₹30 crores: State Government (Cabinet).

Exclusivity:

Projects selected for fiscal/non-fiscal incentives under this tourism policy will not be eligible for incentives under the Bihar Industrial Investment Promotion Policy 2016 or any other policy/plan of the state government.

Interpretation:

The interpretation of any section of this tourism policy will be at the final and binding discretion of the Department of Tourism, Bihar.

Review authority:

The Dept. of Tourism, Bihar, reserves the right to review matters related to incentives.

***